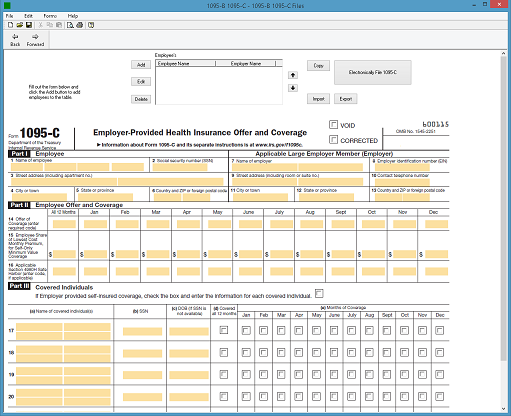

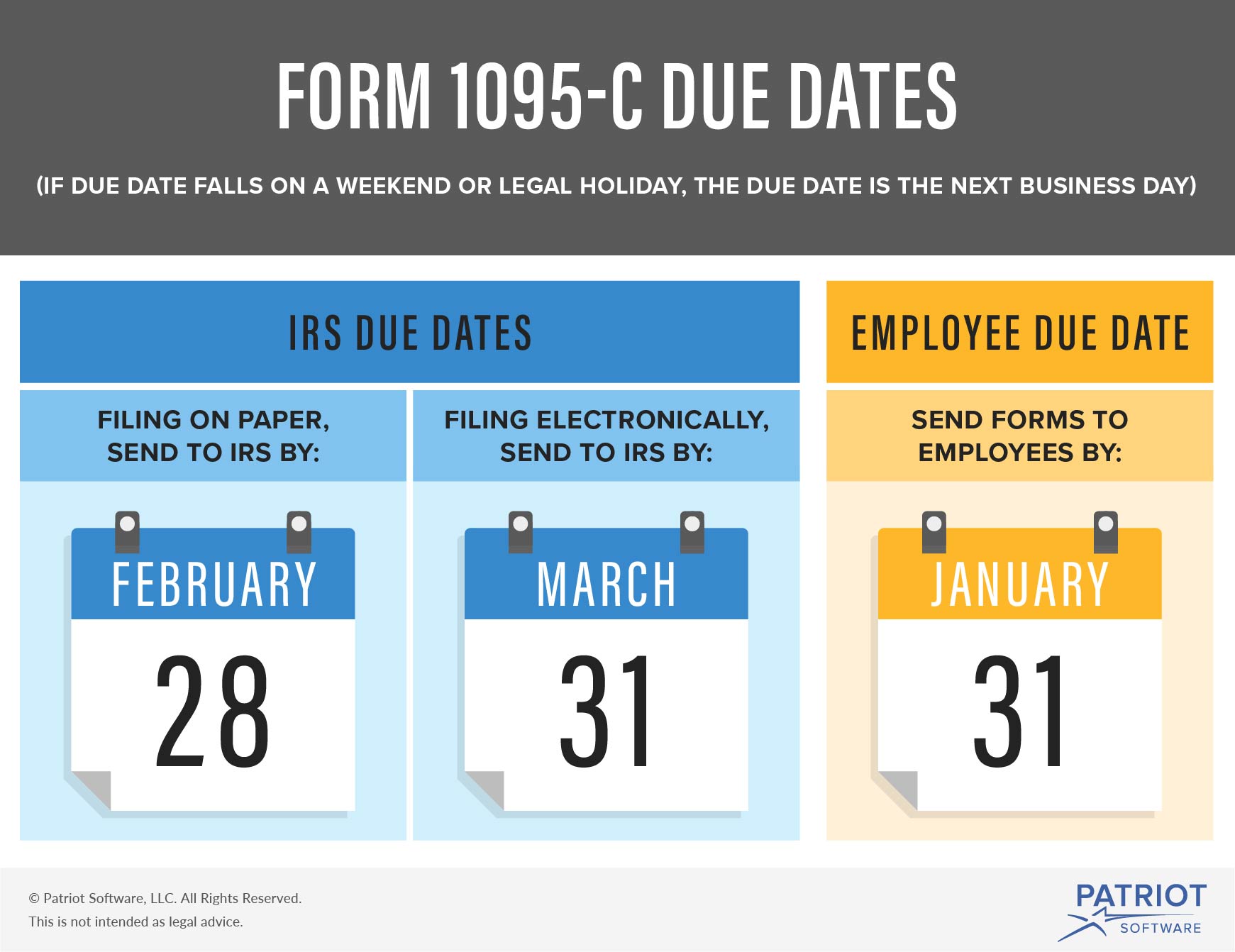

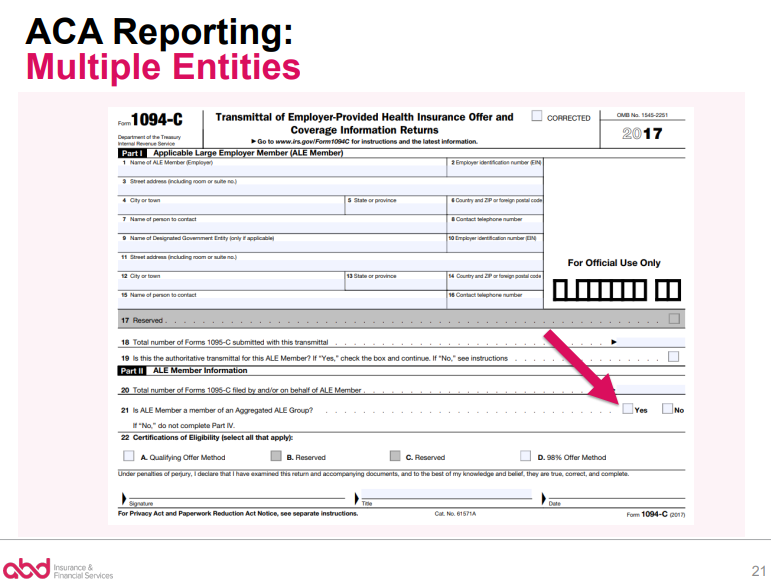

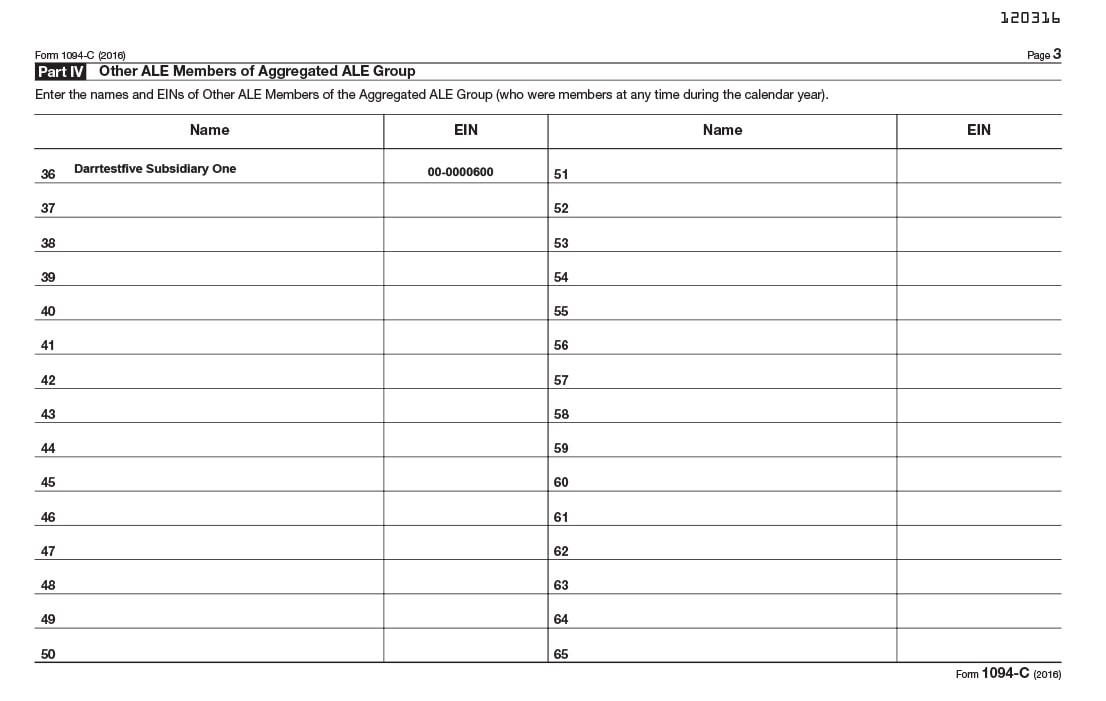

— Individual statements (Form 1094 C) for 21 must be furnished to employees by this date — If filing paper returns, Forms 1094 C and 1095 C must be filed by this date — If filing electronically, Forms 1094 C and 1095 C must be filed by this date Penalties1 Enter employer details 2 Enter covered individuals details 3 Enter ALE Member Information 4 Review your Form 1095C / 1094C 5 Transmit your Form 1095C to the IRS 6 Employee Copy (Postal Mailing) EFile 1095C•YearEnd Close created IRS Forms 1094C and 1095C •You are clicks away from filing •Check to see if you need to do any editing for the 1094C •You may be part of a controlled group where another entity processed their own returns You still need to reference them in Part IV

1095 C Form Official Irs Version Discount Tax Forms

1094-c and 1095-c filings

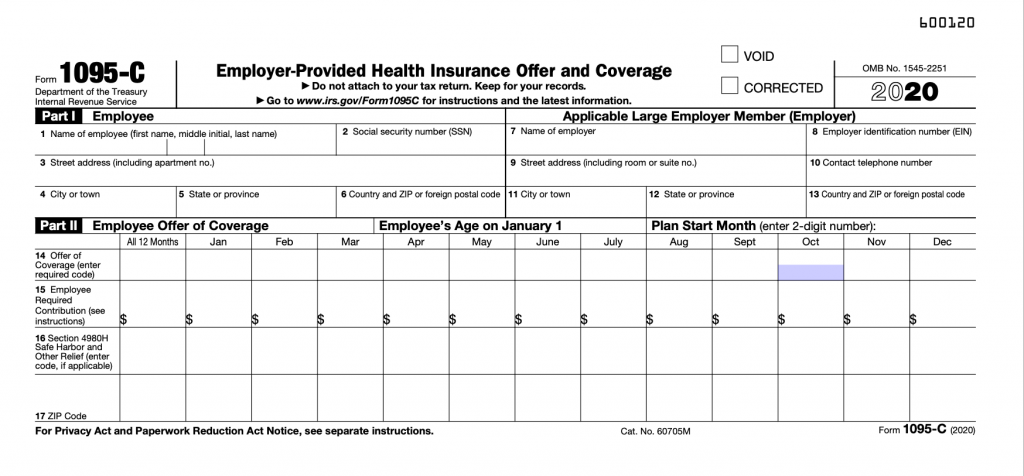

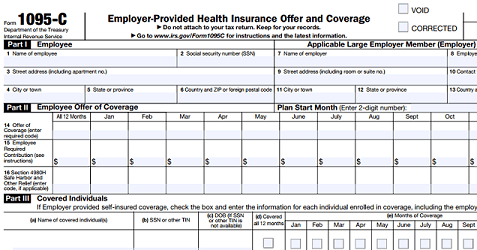

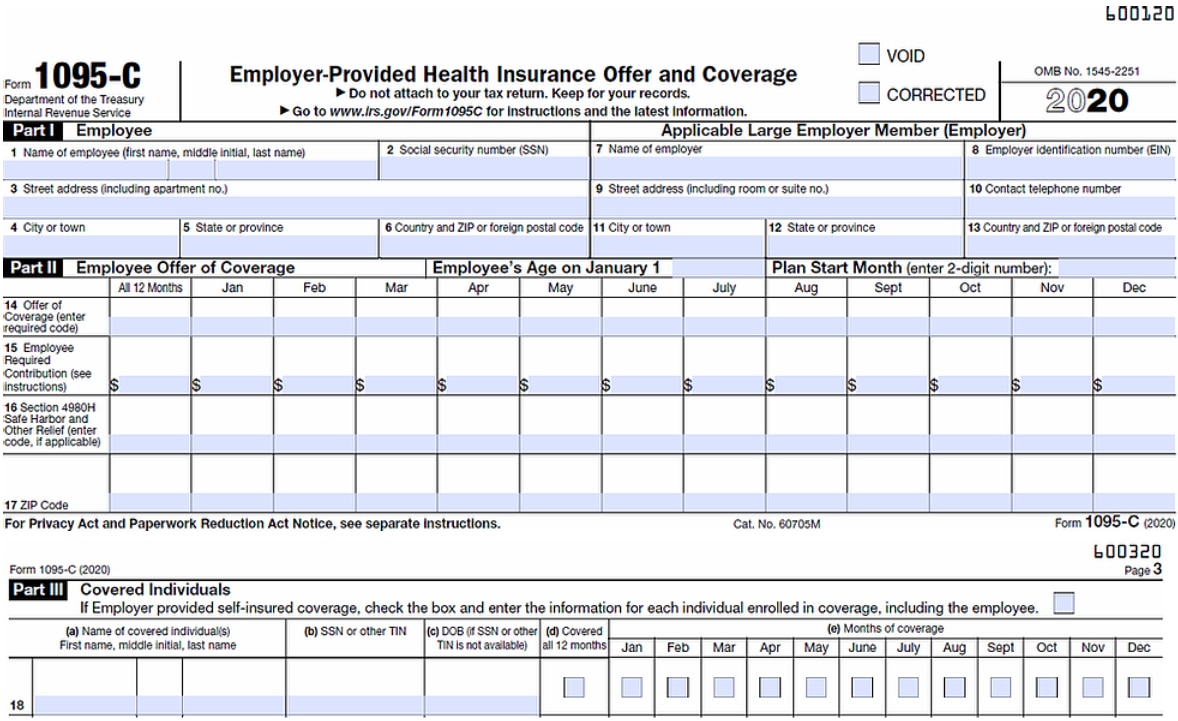

1094-c and 1095-c filings-Information about Form 1095C, EmployerProvided Health Insurance Offer and Coverage, including recent updates, related forms, and instructions on how to file Form 1095C is used by applicable large employers (as defined in section 4980H(c)(2)) to verify employersponsored health coverage and to administer the shared employer responsibility provisions of section 4980HDirections for filing can be found at the IRS website US Office of Personnel Management

trix Irs Forms 1094 C

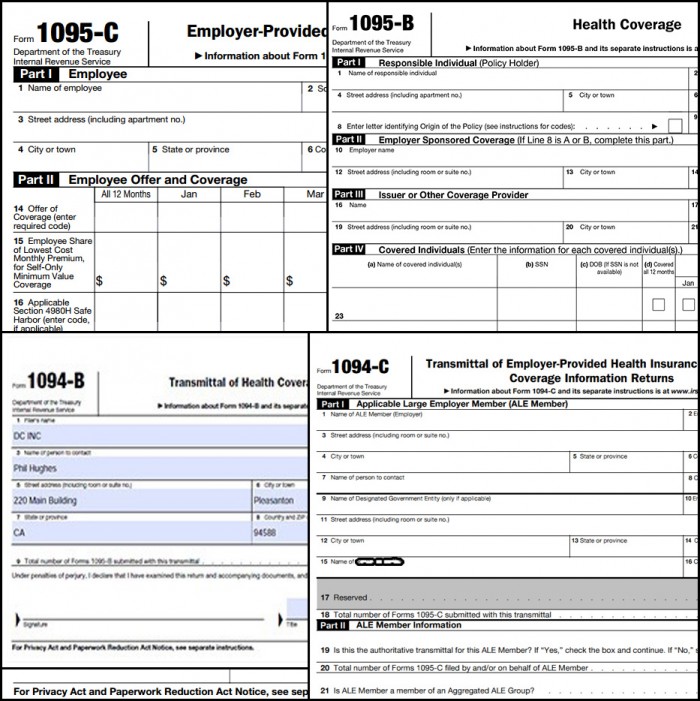

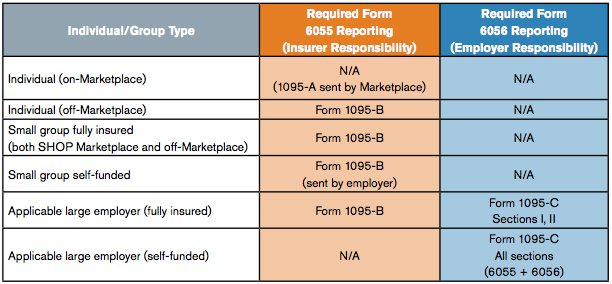

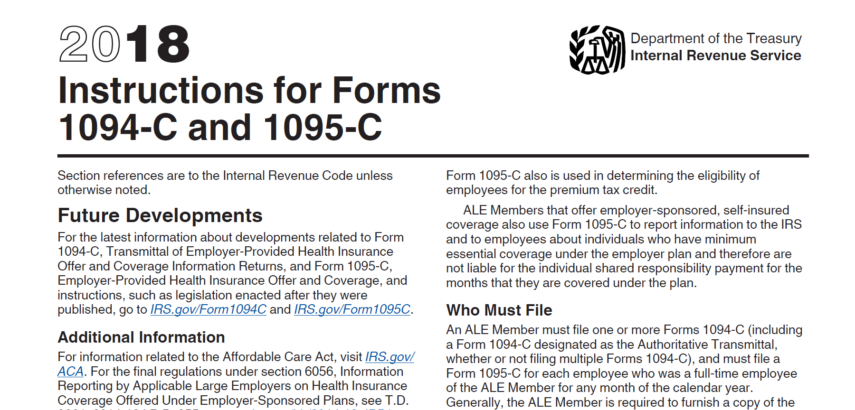

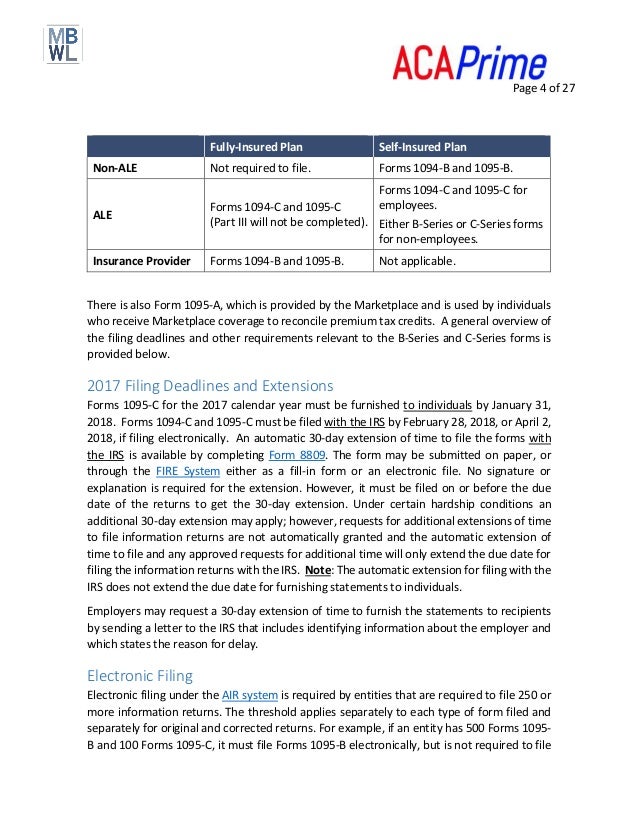

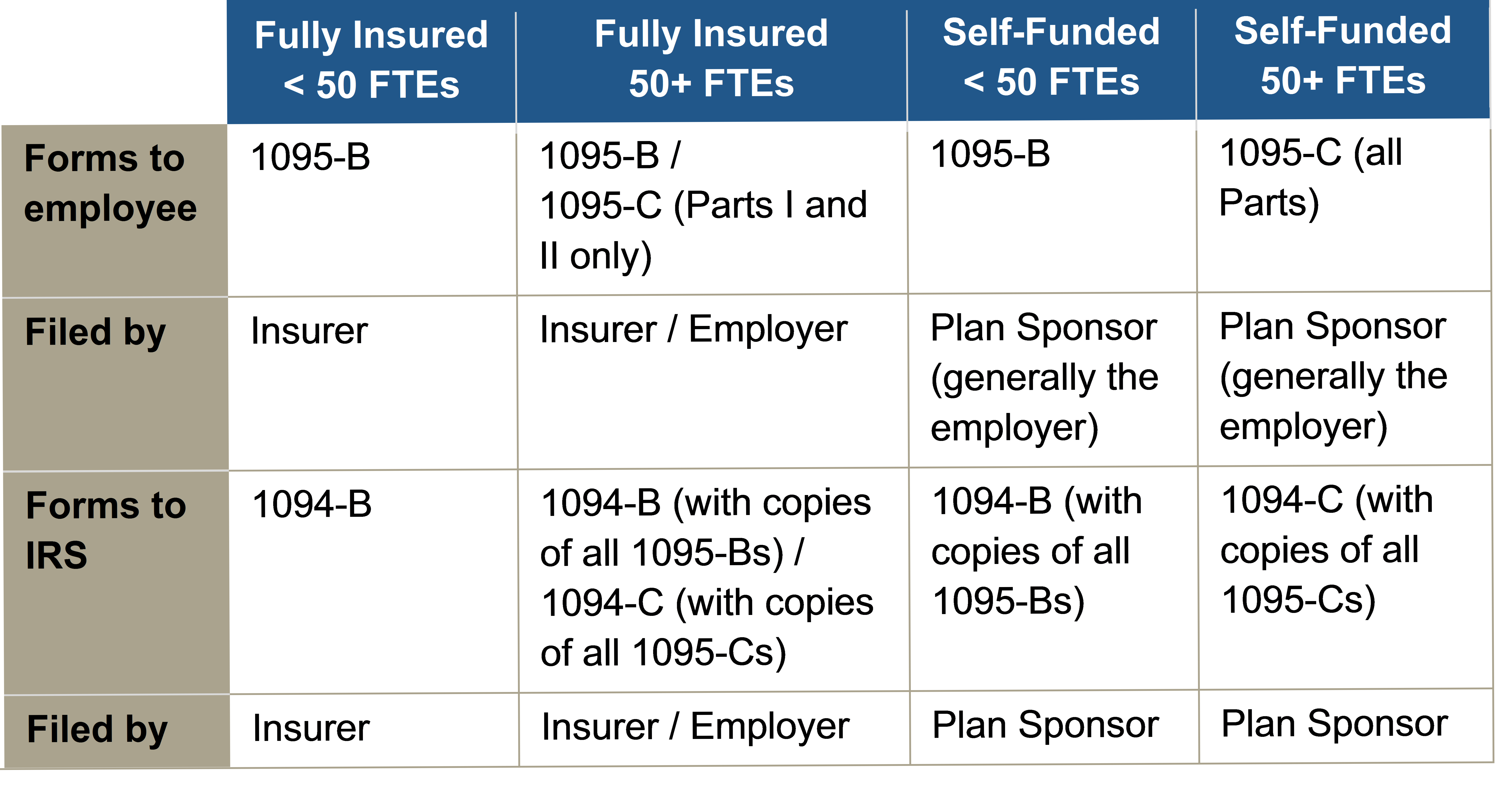

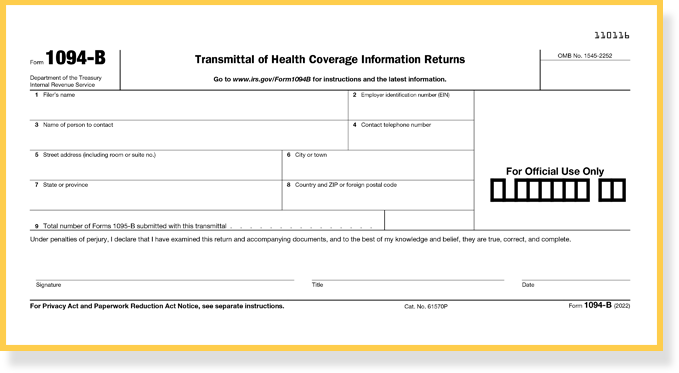

Instructions for Forms 1094C and 1095C Forms 1094B/ 1094B Information in form 1095 B is reported to the IRS and taxpayers regarding employees who are covered by minimum essential coverage (which includes governmentsponsored programs, eligible employersponsored plans, individual market plans, other Department of Health and Human ServicesSubstitute Federal Forms 1094C and 1095C If you are filing federal Forms 1094C and 1095C on paper, get federal Publication 5223, General Rules and Specifications for Affordable Care Act Substitute Forms 1095A, 1094B, 1095B, 1094C, and 1095C, for specifications for private printing of substitute federal Forms 1094C and 1095C1094B/1095B and 1094C/1095C Upload Specifications Files must be created using a piped delimited text (txt) file format XML, Zip or compressed files will NOT be accepted Files 250MB or larger must be submitted as multiple submissions Files that are 250MB or larger will be rejected

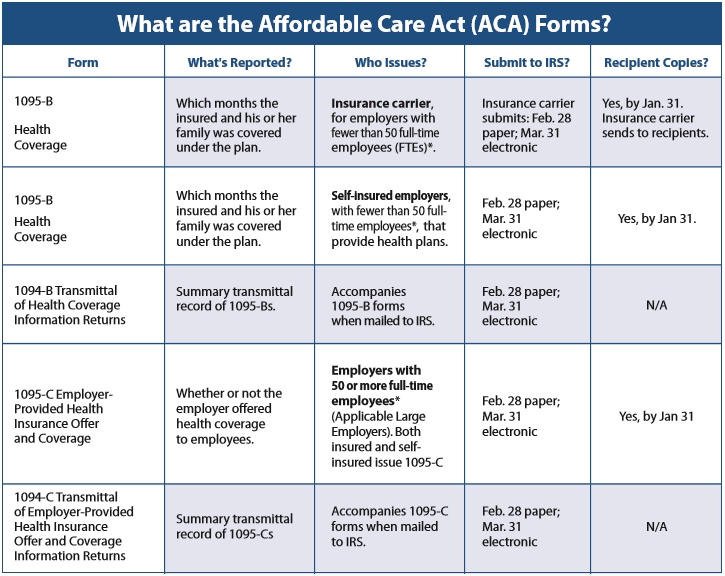

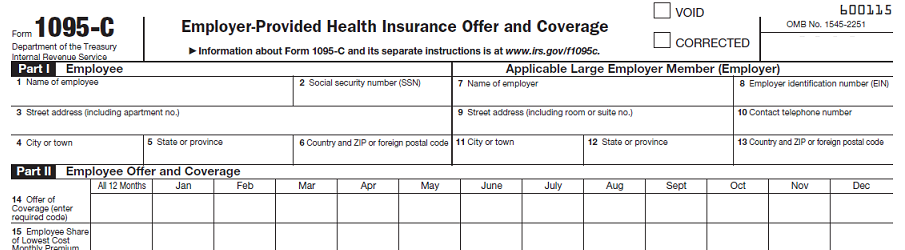

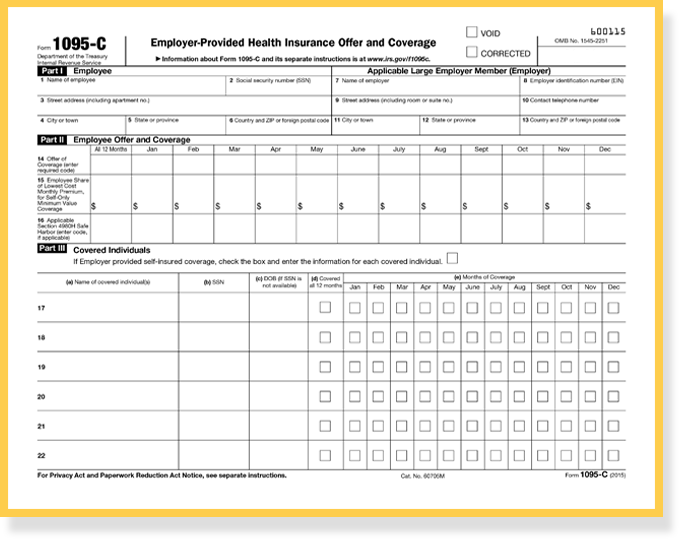

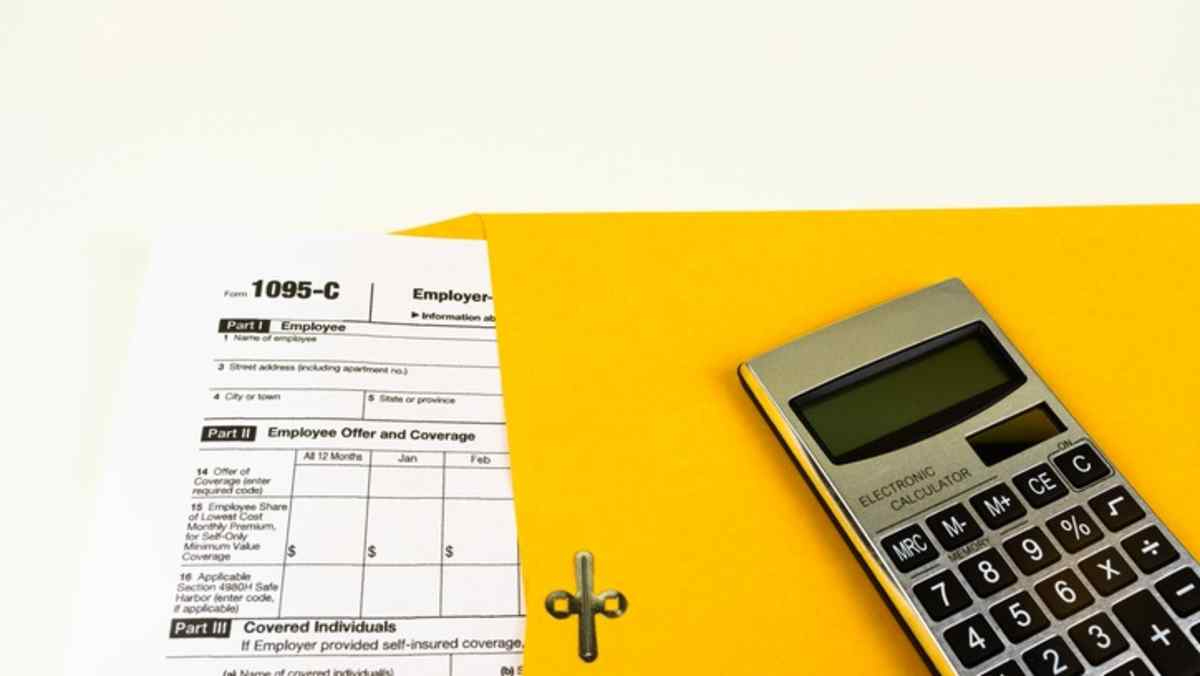

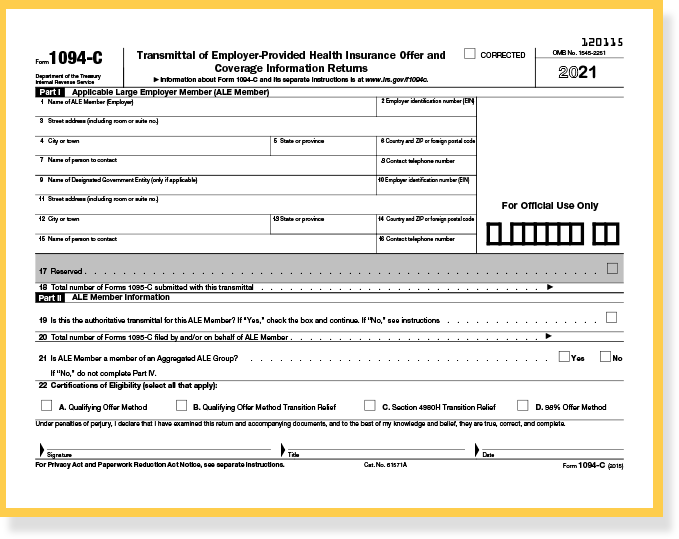

Filing season can be an administrative headache The IRS estimates that the Form 1094C alone can take up to four hours to complete The Form 1095C, which is sent to both employees and the IRS, clocks in at only 12 minutes per form For a company with 100 employees, that means you'll spend 25 hours completing themAn ALE Member must file one or more Forms 1094C (including a Form 1094C designated as the Authoritative Transmittal, whether or not filing multiple Forms 1094C), and must file a Form 1095C for each employee who was a fulltime employee ofForm 1095C is a new form designed by the IRS to collect information about ALEs and the group health coverage, if any, they offer to their fulltime employees Employers provide Form 1095C (employee statement) to employees and file copies, along with Form 1094C (transmittal form), to the IRS Form 1095C is comprised of three parts

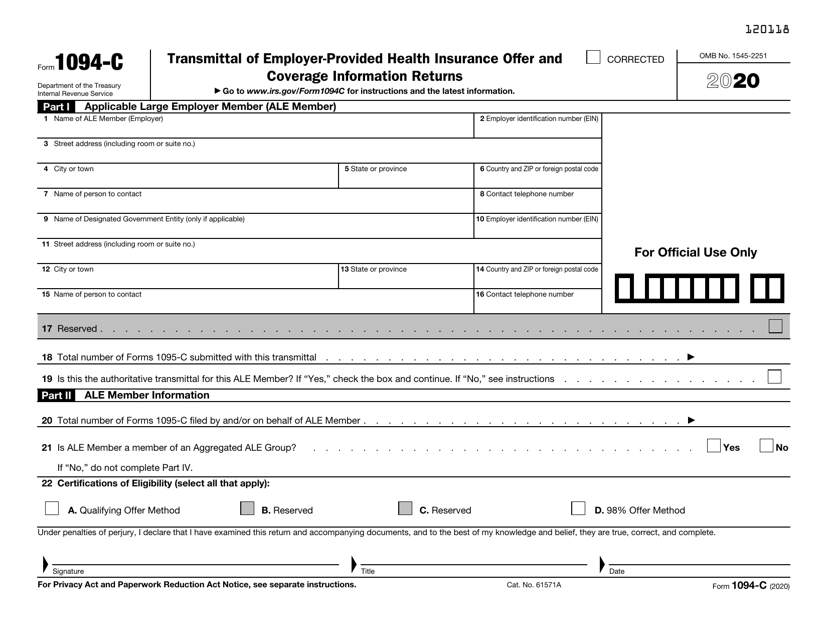

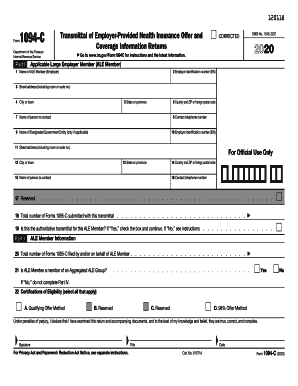

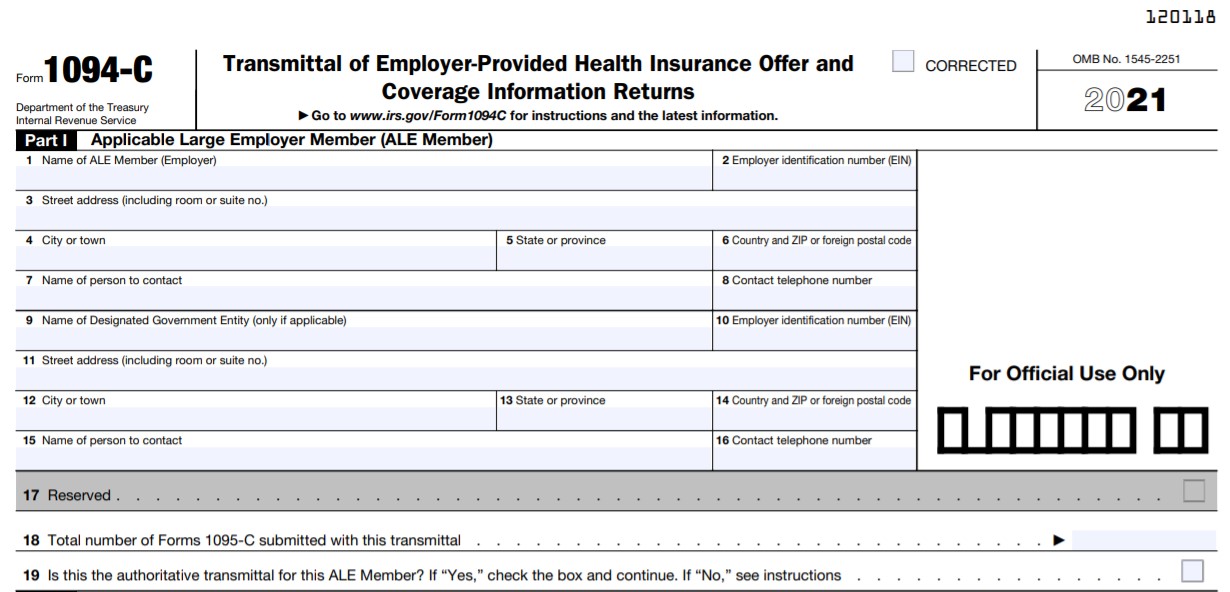

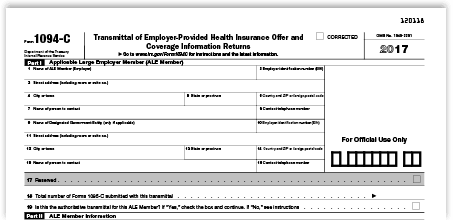

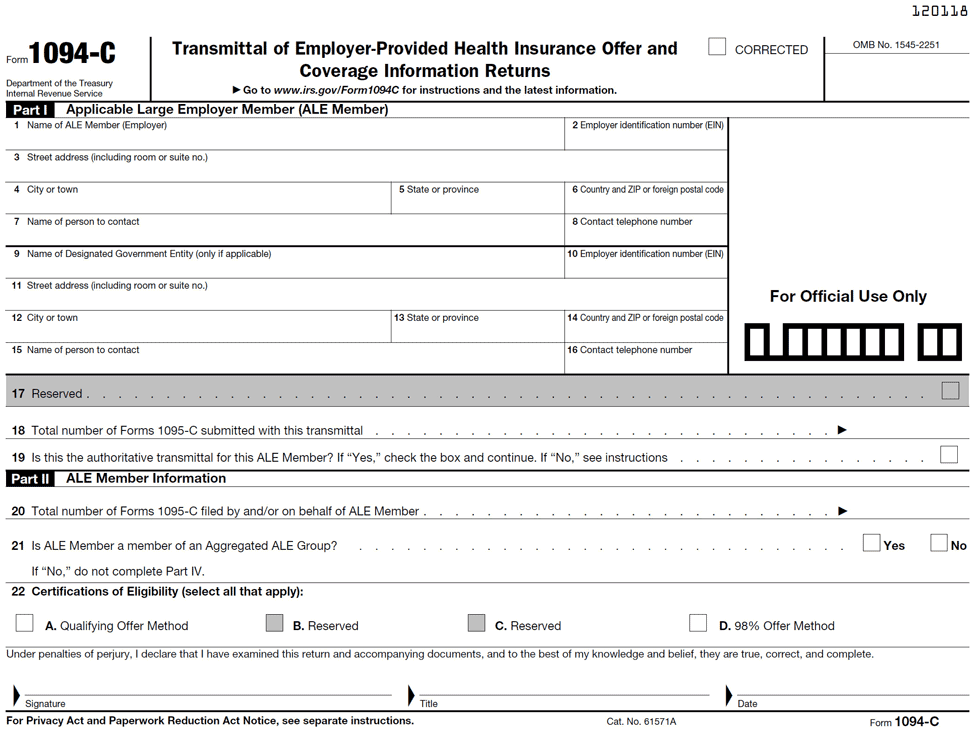

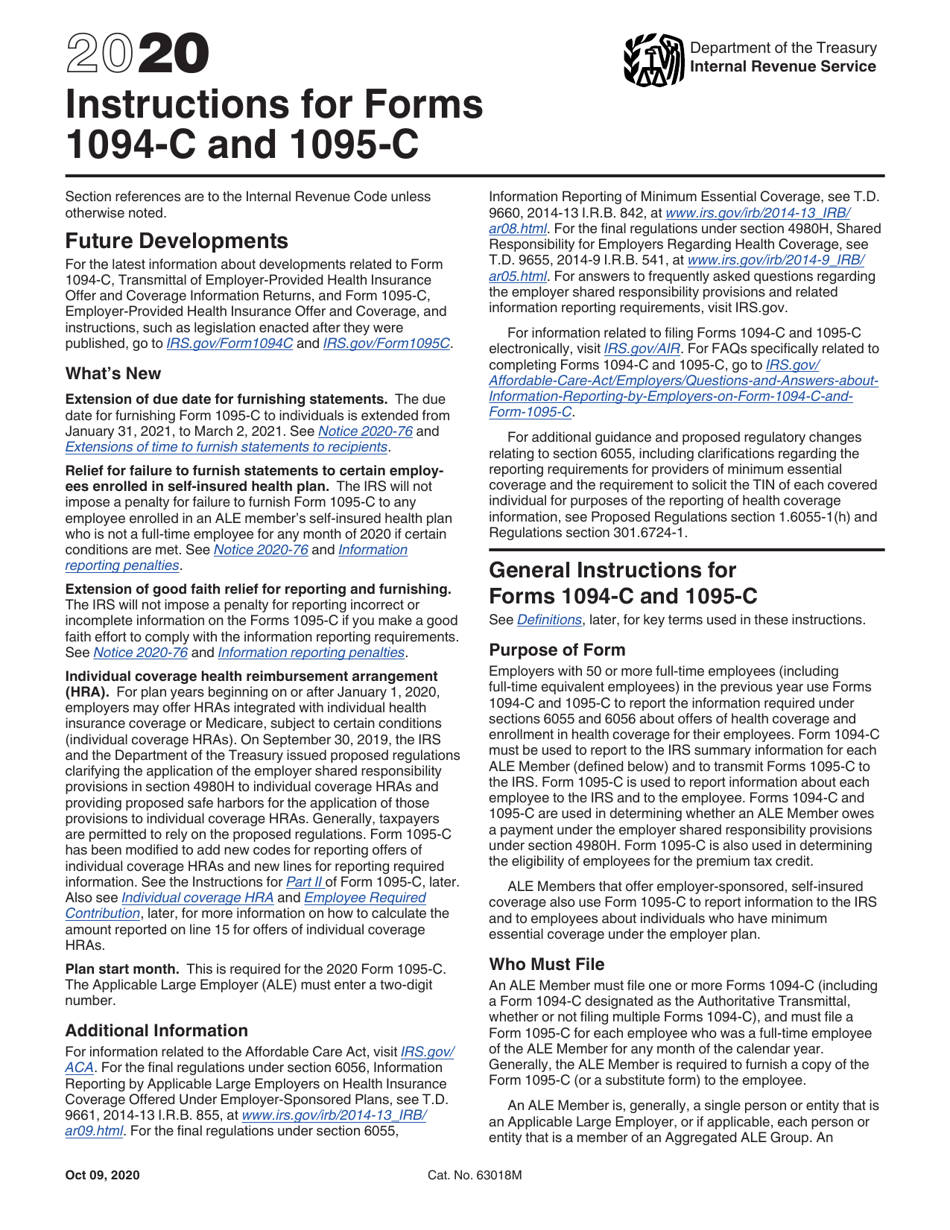

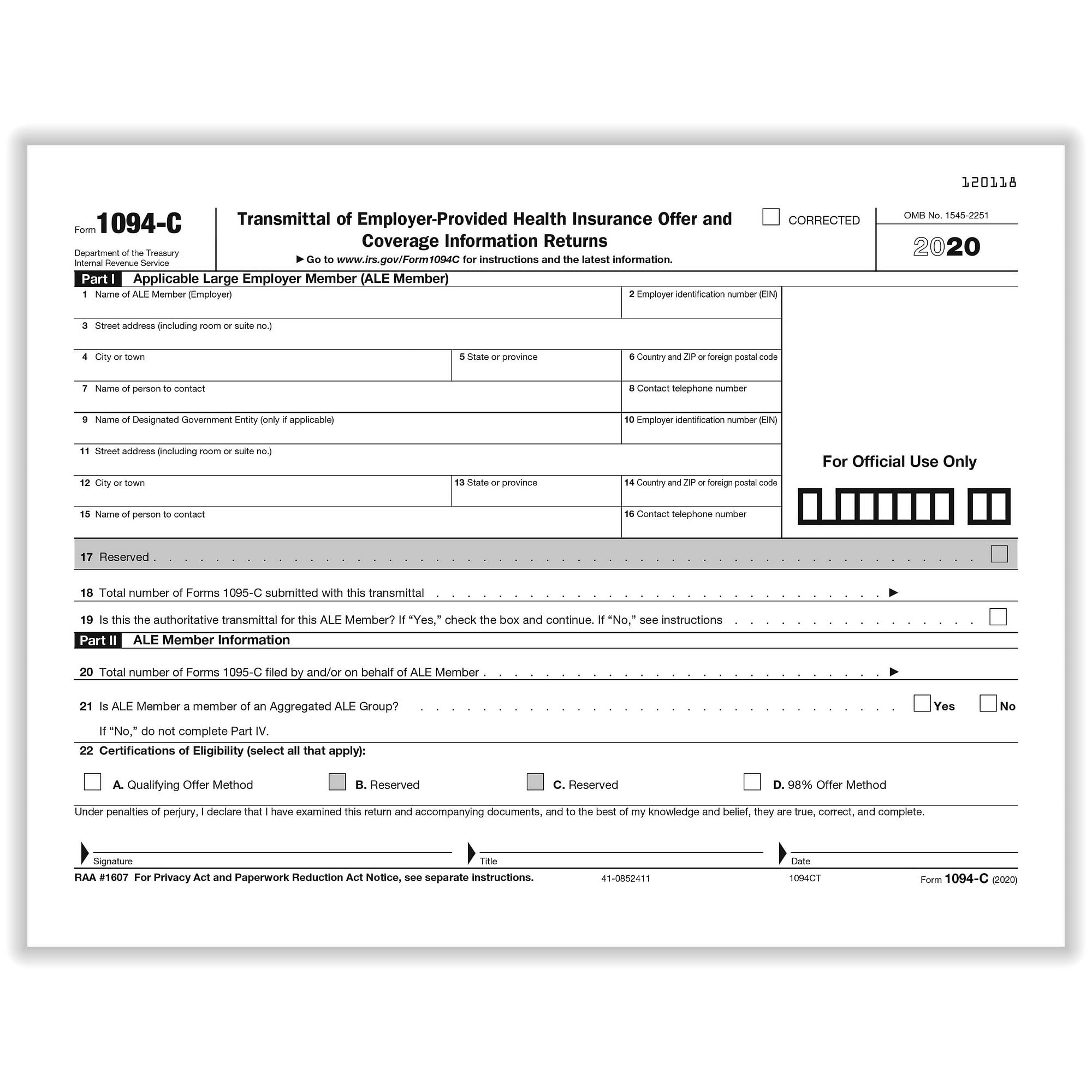

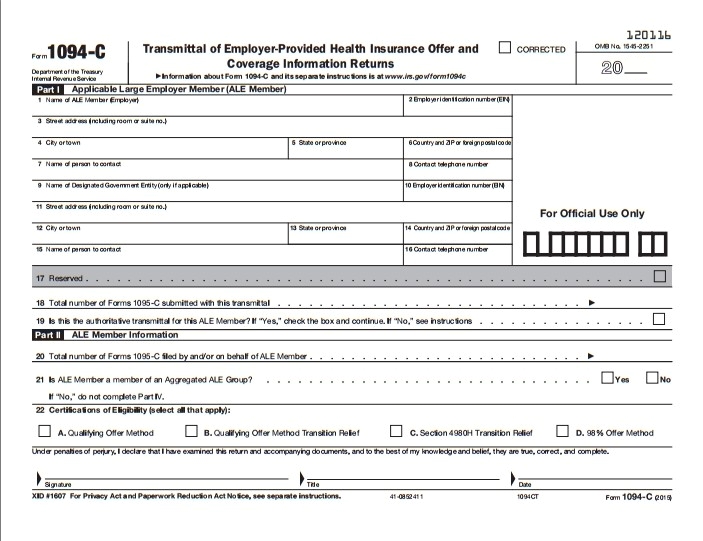

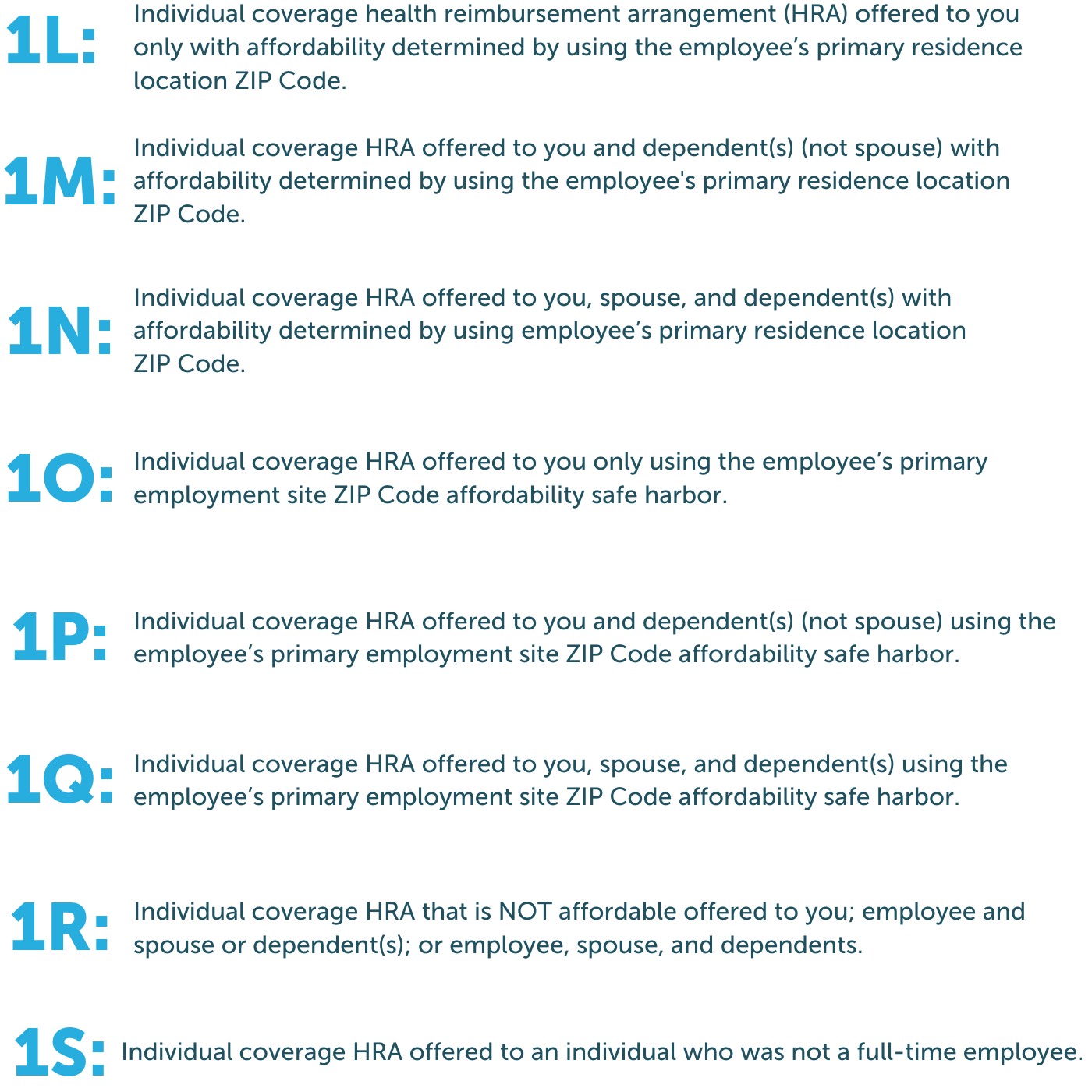

The instructions for Forms 1094C and 1095C confirm that an offer of ICHRA coverage to a fulltime employee counts toward the 95% threshold to avoid an employer shared responsibility penalty under Code §IRS Form 1094C, Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Returns Form 1094C is used by Applicable Large Employers (ALEs), or employers that had 50 or more fulltime employees during the calendar year ALEs must file Form 1095C for each of their employees to disclose information about the healthcare coverage and enrollment offeredForm 1094C functions as the transmittal cover sheet for your Forms 1095C, and is only filed with the IRS—it is not distributed to your employees Form 1094C requires information including how many people you employ and how many Forms 1095C you are filing Read more about Form 1094C on the IRS website Generally, each FEIN will have its

1094 C 1095 C Software 599 1095 C Software

Control Files And Sample Forms

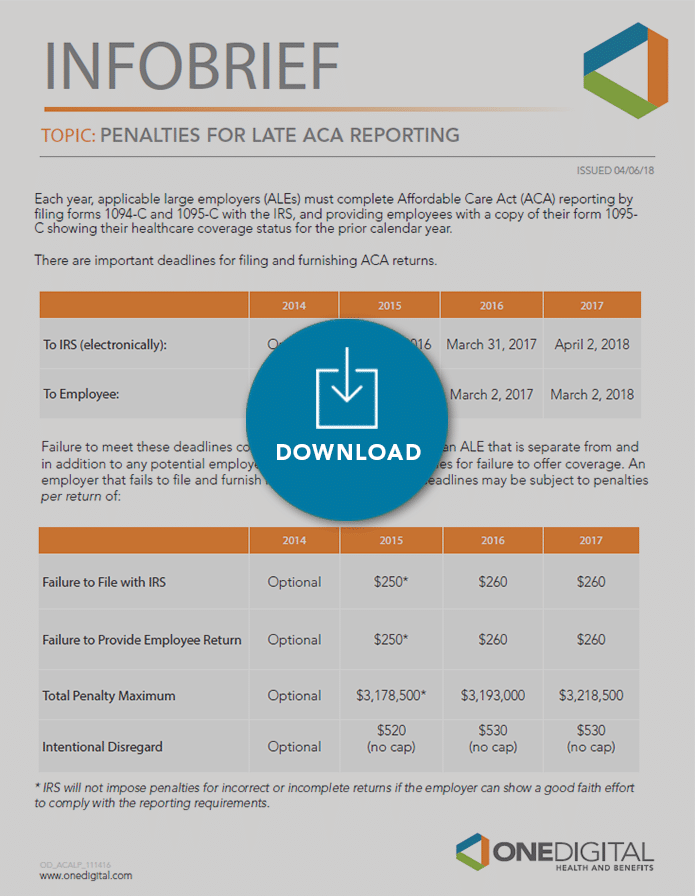

The 1094C and 1095C filings used by Applicable Large Employers along with employee tax returns will be used by the IRS to determine if the employer owes a shared responsibility payment and whether employees are/were eligible for a premium subsidy Any penalties will be calculated and communicated by the IRS in Letter 226J Employers owe the IRS aFiling Forms 1094C and 1095C By Mail Companies that wish to submit forms 1094C and 1095C on paper to the IRS instead of efiling through the Zenefits ACA Compliance app can do so by following the guidance below According to IRS Regulations, only companies that have fewer than 250 1095C forms have the option to submit their filings to theEmployers will file copies of Forms 1095C with transmittal Form 1094 C to the IRS The employer will indicate on Form 1094 C if it is eligible for alternative (simplified) reporting Employers also will use this form to certify that the employer is eligible for transition relief under the ACA "play or pay" rules, if applicable

Irs Issuing 1094 C 1095 C Penalties Essential Staffcare

Alert Irs Extends Due Date For Forms 1095 C And 1095 B

Small employers must file Forms 1095C and 1094C if they are members of a controlled or affiliated service group Last December, the IRS also posted Instructions for Forms 1094C and 1095C4980H(a), regardless of whether the ICHRA coverage is considered affordable This conclusion affects reporting on Form 1094C, Part IIIThe initial Forms 1094C/1095C filing season is finally behind us Unfortunately, if you've discovered errors with the forms filed with the IRS or provided to employees, there may still be some lingering issues that should be addressed to avoid potential penalties Like other information returns filed annually with the IRS, late, incorrect or incomplete Forms 1094C and 1095C

Your Complete Guide To Aca Forms 1094 C And 1095 C

Get To Know Aca Forms 1094 C And 1095 C The Aca Times

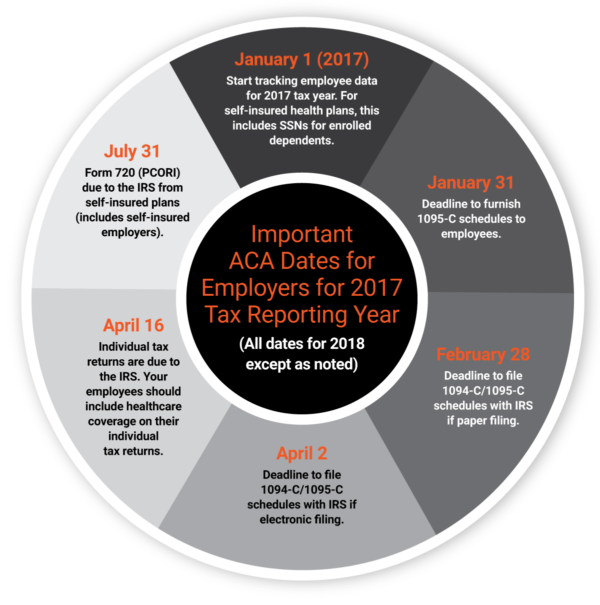

An ALE Member must file one or more Forms 1094C (including a Form 1094C designated as the Authoritative Transmittal, whether or not filing multiple Forms 1094C), and must file a Form 1095C for each employee who was a fulltime employee ofGenerally, you must file Forms 1094C and 1095C by February 28 if filing on paper (or March 31 if filing electronically) of the year following the calendar year to which the return relates For calendar year 18, Forms 1094C and 1095C are required to be filed by , or , if filing electronicallyThe deadline to send forms 1095C and 1094C to the IRS on paper is , when filing electronically the due date is All data needed to fill 1095C / 1094C forms can be saved for later use and modification (forms stored for future access and corrections)

Guide To Correcting Aca Reporting Mistakes

Irs Form 1094 C Download Fillable Pdf Or Fill Online Transmittal Of Employer Provided Health Insurance Offer And Coverage Information Returns Templateroller

Large employers subject to Section 6056 will be reporting health coverage information on Forms 1094C and 1095C beginning in January 16 The ACA also requires those who offer minimum essential health care coverage to individuals toSelecting Your 1095C Software Passport Software's 1095C software does more than just print and efile 1094 and 1095 forms Our Affordable Care Act software solution simplifies compliance throughout the year Other 1095 software products that only provide forms can be a costeffective way to paper file and electronically submit forms 1094C and 1095CForm 1094C and Form 1095C are forms used to report required information about healthcare to the IRS Following the Affordable Care Act (ACA), all applicable large employers (ALEs) need to report whether they've offered health coverage to each employee and whether those employees are enrolled in health coverageForm 1094C is the

Good Sense Guide To Minimum Essential Coverage Forms 1094 C And 1095 C Ca Benefit Advisors Arrow Benefits Group Complex Questions Straight Answers

2

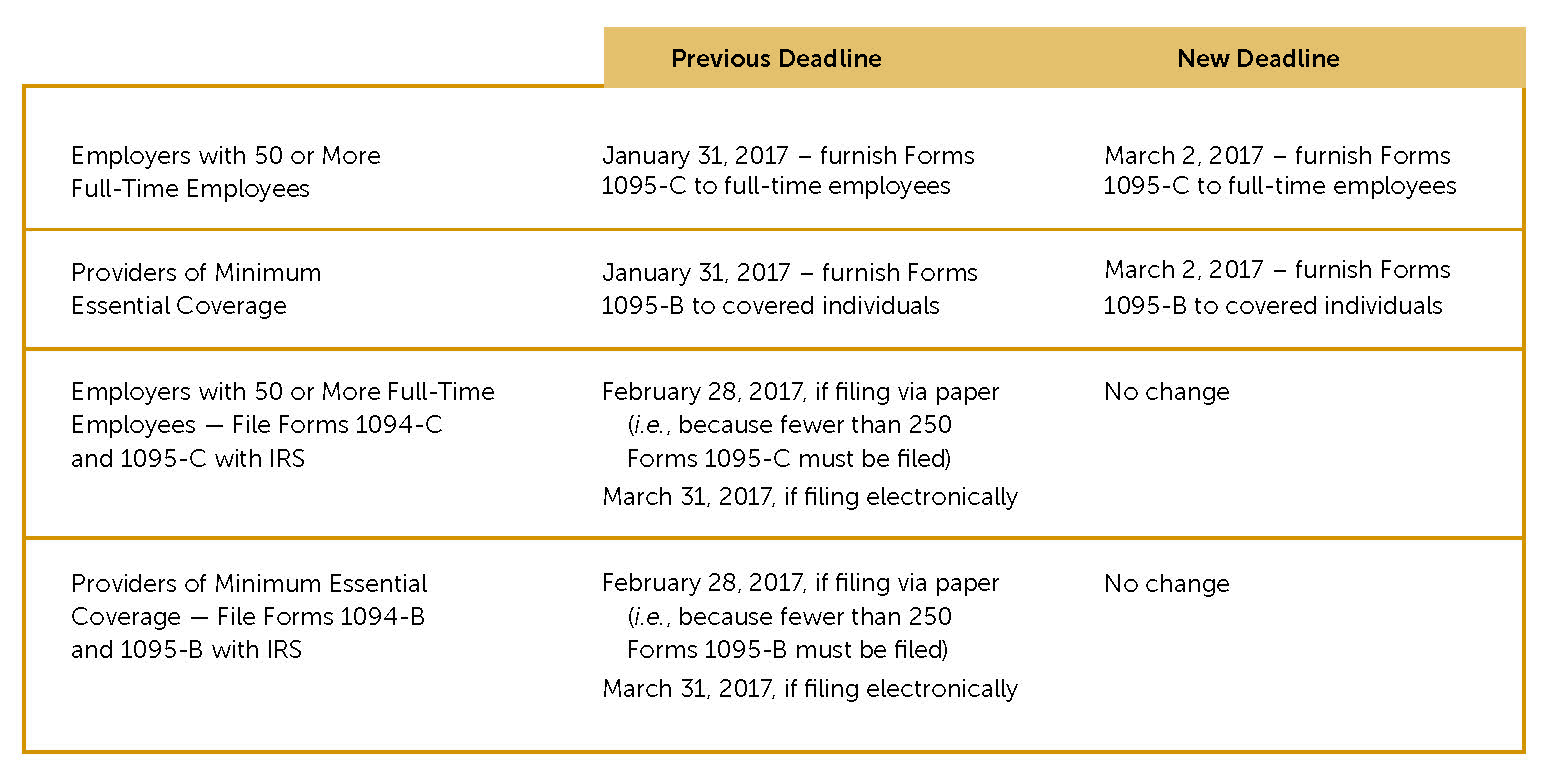

The 1095C forms for 15 are now due to individuals by Normally, forms 1094C and 1095C must be provided to the IRS by February 28th (March 31st, if filed electronically) of the year following the year to which the statement relates Because of the extension, for calendar year 15, the 1094C and 1095C forms are required toForm 1094C is a transmittal to the IRS that, in combination with Form 1095C providing individualized information, satisfies these requirements Form 1095C is furnished to individuals, but Form 1094C is not There are separate deadlines for filing forms with the IRS and furnishing statements to individuals Filing With IRS ALEs must fileLarge employers who are selfinsured are typically going to use just Forms 1094C and 1095C Extended deadline for participant statements The IRS has extended the deadline for furnishing Forms 1095B and 1095C to individuals The typical deadline to report 19 plan information is

State Individual Mandates Add To Employer Reporting Responsibilities Foster Foster

trix Irs Forms 1094 C

Mailing Instructions for Filing Paper Forms 1094C and 1095c Here are some general tips for employers who wish to file their Forms 1094C and 1095C by mail Send the forms to the IRS in a flat mailing (not folded) Do not paperclip or staple the forms together Check for the correct IRS address Postal regulations require all forms andEven if the ALE files the 1094C/1095C late, it still might trigger an employer shared responsibility payment (ESRP) assessment based on the information filed on the 1094C/1095C If the information filed on those forms is accurate, then the ESRP assessment would be the correct amount the employer owes the IRS under the provisionHow do I electronically file Forms 1094C and 1095C with the Internal Revenue Service (IRS)?

Let S Look At The Most Common 1095 C Coverage Scenarios Integrity Data

Avoid Common Errors This Aca Reporting Season Health E Fx

Inst 1094C and 1095C Instructions for Forms 1094C and 1095C 15 Inst 1094C and 1095C Instructions for Forms 1094C and 1095C 14 Form 1094C Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Returns Form 1094C Transmittal of EmployerProvided Health Insurance Offer and Coverage InformationThe IRS has started to issue a new round of ACA penalties that focus on failure to distribute 1095C forms to employees and to file 1094C and 1095C forms with the federal tax agency by required deadlines These are penalties in addition to penalties for not offering the required healthcare coverageIRS Forms 1094C and 1095C are filed by employers that are required to offer health insurance coverage to their employees under the Affordable Care Act, also known as Obamacare The main difference between them is that the 1095C provides information about health insurance and is sent to both employees and the IRS, while the 1094C acts as a cover sheet about the 1095C

Explanation Of 2d On Line 16 Of The Irs 1095 C Form Integrity Data

Payroll Systems Things To Consider When Filing Forms 1095 C 1094 C Payroll Systems

Information about Form 1094C, Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Returns, including recent updates, related forms, and instructions on how to file Form 1094C is the transmittal form that must be filed with the Form 1095CIncluded on Form 1095C is information regarding Employers that fail to submit ACA Forms 1094C and 1095C annually could be subject to penalties under IRC 6721/6722 in Letter 5005A/Form 6A These penalties are separate from those assessed by the IRS for failing to comply with the responsibilities of the ACA's Employer MandateAn ALE Member must file one or more 1094C forms (including a 1094C designated as the Authoritative Transmittal, whether or not filing multiple Forms 1094C), and must file a 1095C for each employee who was a fulltime employee for any month of the year Generally, the ALE Member is required to furnish a copy of Form 1095C (or a substitute

Aca Reporting Filing Compliancebug

2

For electronic filings with the IRS of all 19 Forms 1095C or 1095B, along with transmittal Form 1094C or 1094B Employers filing 250 or more forms are required to file electronically with the IRS Employers should become familiar with these forms in preparation for filing information returns for the 18 calendar yearForm 1094 is simply the cover sheet for your Forms 1095 This one only needs to be sent to the IRS There are different versions of Form 1095, such as 1095A, 1095B, and 1095C These letters determine who must file the forms based on the type of insurance offered Form 1095A is completed when insurance comes from the health insuranceFor the filing year, Applicable Large Employers (ALEs) must provide Forms 1095C to employees by ALEs must submit Forms 1095C, along with Form 1094C, to the IRS by (if filed by mail) or (if filed electronically) Note Employers that are required to file 250 or more 1095C Forms must file electronically

Form 1094 C 1095 C Reporting Basics And Ale Calculator Bernieportal

Irs Form 1095 C Codes Explained Integrity Data

Applicable Large Employers (ALE) are still required to report coverage for the year Form 1095C and Form 1095B statements must be provided to fulltime employees by The due date for electronically filing Forms 1094/1095B and 1094/1095c1095 – C is like a W2 Each employee must receive a 1095C from the employer and a copy is also submitted to the government 1094C is like a W3 Aggregate of all 1095C data This file is submitted either electronically or via mail to the government First 1094C Filing is (March 31st if filed electronically)The deadlines for filing Form 1095C with the IRS and furnishing copies to the recipient are as follows , is the deadline to distribute recipient copies , is the deadline to paper file Forms 1095C with the IRS , is the deadline to efile Forms 1095C

1094 C 1095 C Preparation Review Training Section One Youtube

1094 C And 1095 C Reporting Youtube

Tax Year 21 Forms 1094B, 1095B, 1094C, and 1095C Affordable Care Act Information Returns (AIR) Release Memo, XML Schemas and Business Rules Version 10What are Forms 1094C and 1095C?The IRS imposes penalties for late filing of Forms 1094C and 1095C or for late furnishing of Forms 1095C under Internal Revenue Code (IRC) Sections 6721 and 6722 These penalties can be huge depending on the number of late Forms 1095C, at a rate of $270 per form for failure to file and an additional $270 per form for failure to furnish for

Your 1095 C Obligations Explained

The Instructions For Forms 1094 C And 1095 C Blog Taxbandits

Inst 1094C and 1095C Instructions for Forms 1094C and 1095C 15 Inst 1094C and 1095C Instructions for Forms 1094C and 1095C 14 Form 1095C EmployerProvided Health Insurance Offer and Coverage Form 1095C EmployerProvided Health Insurance Offer and Coverage1094C 1095C ACA Compliance ACA Individual Mandate ACA Penalties ACA Reporting Affordable Care Act Congress DC 1094/1095 Filing Health Care Coverage Minimum Essential Coverage (MEC) MyTaxDC Office of Tax and Revenue (OTR) Washington DC

A Z Important Terms To Know For Forms 1094 1095 C Ts1099 Ts1099

Form Irs 1094 C Fill Online Printable Fillable Blank Pdffiller

Control Tables And Sample Forms

What You Need To Know About Forms 1094 1095

1095 C Submit Your 1095 C Form Onlinefiletaxes Com

1

Aca Filing Services 6055 Reporting Form 1094 C

Ez1095 Software How To Print Form 1095 C And 1094 C

Guide To Prepare Irs Aca Form 1094 C Form 1094 C Step By Step Instructions

The Instructions For Forms 1094 C And 1095 C Blog Taxbandits

Form 1095 A 1095 B 1095 C And Instructions

:max_bytes(150000):strip_icc()/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

Irs Form 1094 C Form 1094 C Online 1095 C Transmittal Form

Affordable Care Act Form 1095 C Form And Software Hrdirect

2

1095 C 1094 C Aca Software To Create Print E File Irs Form 1095 C

1095 Software Aca Software 1095 Reporting

Pin On Aca Reporting

Affordable Care Act Electronic Filing Instructions

1095 C Reporting Determining A Company S Ale Status Integrity Data

The Irs Releases Final 1094 C 1095 C Forms And Instructions For 18 Tax Year Foster Foster

2

Missed The 1095 C Deadlines Now What Onedigital

Irs Reporting Under The Affordable Care Act Bkd Llp

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

1094 C Transmittal Of Employer Provided Health Insurance 1095c Coverage Info Returns 3 Sheets Form 100 Forms Pack

Irs Announces Relief For Certain Form 1094 1095 Reporting Requirements Mcafee Taft

Aca Compliance Reporting Morris Reynolds Insurance

2

Form 1095 C The Aca Times

Ty Draft Forms 1095 C And 1094 C Released Along With New Form 1095 C Codes Press Posts

2

Aca Employer Reporting Requirements 1094c 1095c Efile4biz

Deadline To File Forms 1094 C And 1095 C Is Near Carr Riggs Ingram

Mbwl Employer S Guide To Aca Reporting

1095 C Form Official Irs Version Discount Tax Forms

1095 C Form Official Irs Version Discount Tax Forms

1094 C Form Transmittal Discount Tax Forms

United Benefit Advisors Home News Article

1094 C 1095 C Software 599 1095 C Software

Aca Compliance During The New Presidency And An Early Christmas Present From The Irs Usi Insurance Services

Guide To Prepare Irs Aca Form 1094 C Form 1094 C Step By Step Instructions

An Introduction To The Irs Aca Reporting Forms For Employer Reporting

Yearli Form 1095 C

Common Mistakes In Completing Forms 1094 C And 1095 C

Form 1094 C 1095 C Reporting Basics And Ale Calculator Bernieportal

trix Irs Forms 1095 C

1

Irs Issues Draft Form 1095 C For Aca Reporting In 21

trix 1095 C Efiling Process

2

What Are The Form 1094 C And 1095 C Requirements For Fully Insured Health Plans In

Introduction To Affordable Care Act Health Coverage Returns Air

Aca Compliance Filing Irs Forms 1094 C And 1095 C

Free 1095 C Resource Employee Faqs Yarber Creative

Aca Employer Mandate And Reporting Rules When Acquiring A Non Ale Newfront Insurance And Financial Services

Affordable Care Act Aca Reporting Cheat Sheet Reporting Made Easy Onedigital

1095 Deadlines Cobra Administration Cobra Help Denver Co

Your 1095 C Obligations Explained

1095 C Faqs Mass Gov

Compliance Update Forms 1094 C And 1095 C Calcpa Health Trusted Health Plans For Cpas

Employers Are You Unsure Of The Coding On Forms 1094 C And 1095 C The Aca Times

Irs Reporting Under The Affordable Care Act Bkd Llp

Aca Employer Reporting Requirements 1094c 1095c Efile4biz

Advantage Benefits Group Compliance

Aca Form Generation And Filing

1094

Updates To Form 1095 C For Filing In 21 Youtube

An Introduction To The Irs Aca Reporting Forms For Employer Reporting

1095 C Examples

Smaller Employers Beware Irs Doesn T Want Paper Aca Filings Next Year Or Paper W 2 And Similar Filings For That Matter

Let S Check Those Forms 1094 C Before Filing With The Irs Lockton Companies

What You Need To Know About Aca Annual Reporting Aps Payroll

Guide To Prepare Irs Aca Form 1094 C Form 1094 C Step By Step Instructions

1095 Software Ez1095 Affordable Care Act Aca Form Software

Irs Delays The Deadline To Furnish The Aca Forms 1095 C And 1095 B To March 2 17 And Extends The Good Faith Transition Relief From Reporting Penalties Trucker Huss

Irs Roundup What You Need To Know About The Irs And The Affordable Care Act The Aca Times

Irs Releases Instructions And Draft Form 1094 C And 1095 C Basic

Draft 16 Instructions For Form 1094 C 1095 C Released Boomtax

Irs Form 1095 C Codes Explained Integrity Data

0 件のコメント:

コメントを投稿